Goal Solutions SPV Management leverages decades of market expertise to deliver personalized accounting and investor reporting solutions for complex financing structures. We specialize in enhanced data visualization, full transparency along with expert insights into loan performance.

SPV Management

peace of mind

Fund Administration

Drawing upon its extensive expertise in SPV administration and data visualization, Goal extended its specialized services to cater to funds involved in direct lending, consumer loans, private equity, and structured finance. Goal Solution’s Fund Administration services include Reporting and Financials that offer real-time insights into fund performance and financial health, detailed net asset value (NAV) calculation reports, capital calls and distribution reports, and borrowing base calculations as well as Cash Management and Treasury Services to optimize liquidity and ensure funds are effectively managed.

Automation of Data Collection

Full flexibility in Data Format and Seamless Integration Expertise with internal and external software and databases, making data collection effortless, even in complex environments.

Data Validation and Quality Control

Your data is only as good as its accuracy. We act as a backup Fund Administrator; our dedicated team ensures that the data collected and stored in our data warehouse is rigorously validated against original documents. Any deviation or discrepancy is flagged by our internal quality control tool.

Reporting

Empower your decision-making with insightful analytics, covering Traditional Reports in popular formats, offering a clear snapshot of your data, Interactive Data Visualization and Shareability.

see critical aspects

visualization.

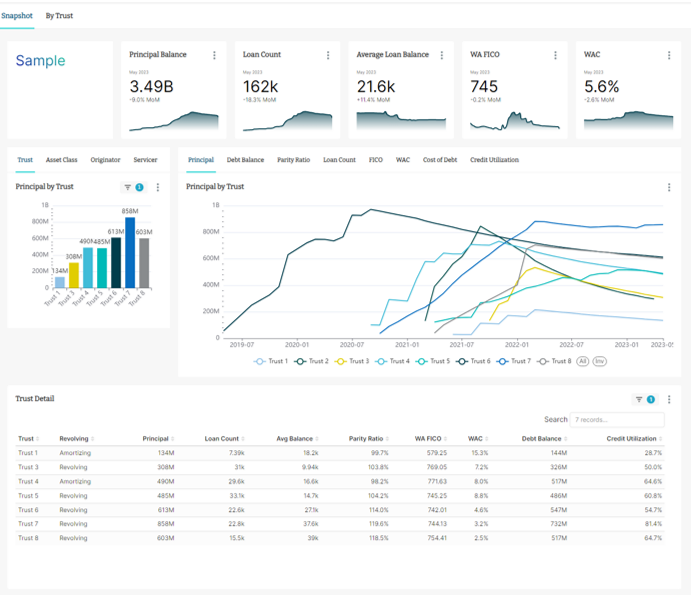

Reporting for securitizations and warehouses visualized across the most critical aspects to easily identify trends and proactively respond to risks

experienced team

expertise.

Backed by decades of experience managing securitizations and warehouses and leveraging a team of dedicated data scientists.

interactive portal

functionality.

An interactive reporting portal providing transparent access to standardized data as well as customizable enhancements.

encryption and compliance

secure.

Full data encryption cloud-hosted platform paired with unique client access point to ensure a fully compliant user interface.

lucidity [ loo-sid-i-tee]

the quality of being easily understood, completely intelligible, & comprehensible.

- Management of raw data feeds into standardized reporting database.

- Transparent data visualization by portfolio and key data sets.

- Identify performance trends and risks across portfolios.

- Visualize & compare multiple portfolios.

- Track ineligible loan trends.

- Proactively monitor triggers and concentration limits, color-coded for trend and risk identification.

- Aggregate portfolio information or delve into specific trusts.

- Most pertinent metrics, all pre-programmed based on extensive experience.

- Customizable to specific client needs.

goal solutions

administration &

reporting

our services

Investor Reporting

Validation, Booking, and Reconciliation of Transaction Activity

Bank Accounts

- Monthly bank roll-forward details account balances and activity

- Standard: collection account, distribution account, and reserve account

Loans (Assets)

- Monthly loan/servicer roll-forward details loan balances and activity

- Borrower principal and interest payments and other activity

Bonds (Liabilities)

- Monthly liability roll-forward details bond balances and activity

- Bond principal balances, payment distributions, and

interest calculations

Trust Expenses

- A/R: Goal administration fees, master servicing fees, and servicing fees

- A/P: trustee fees, 3rd party servicing fees, and rating agency fees

Preparation and Review of Monthly Reporting

Bank Accounts

- Reconciliation of cash

- Summary of balances and transfers for each bank account

Loans (Assets)

- Collection activity and loan performance details

- Stratification tables summarizing loan characteristics

Bonds (Liabilities)

- Balances, interest rates, and relevant dates or day count conventions

- Bond payments based on available funds and trust structure

- Application of credit enhancement and waterfall rules

Payment Instructions

- Issuer orders (or MIOs) provide direction on payment distributions

- Authorized payment of fees, and principal and interest

bond distributions

Cash Reconciliation and Management

peace of mind

Rating Agency, Audit

and Tax Support

Financials