Comprehensive and customizable solutions for loan servicing and asset management, driven by technology, analytics, and industry expertise. We support multiple asset classes and serve an array of client types.

deep knowledge within

asset classes

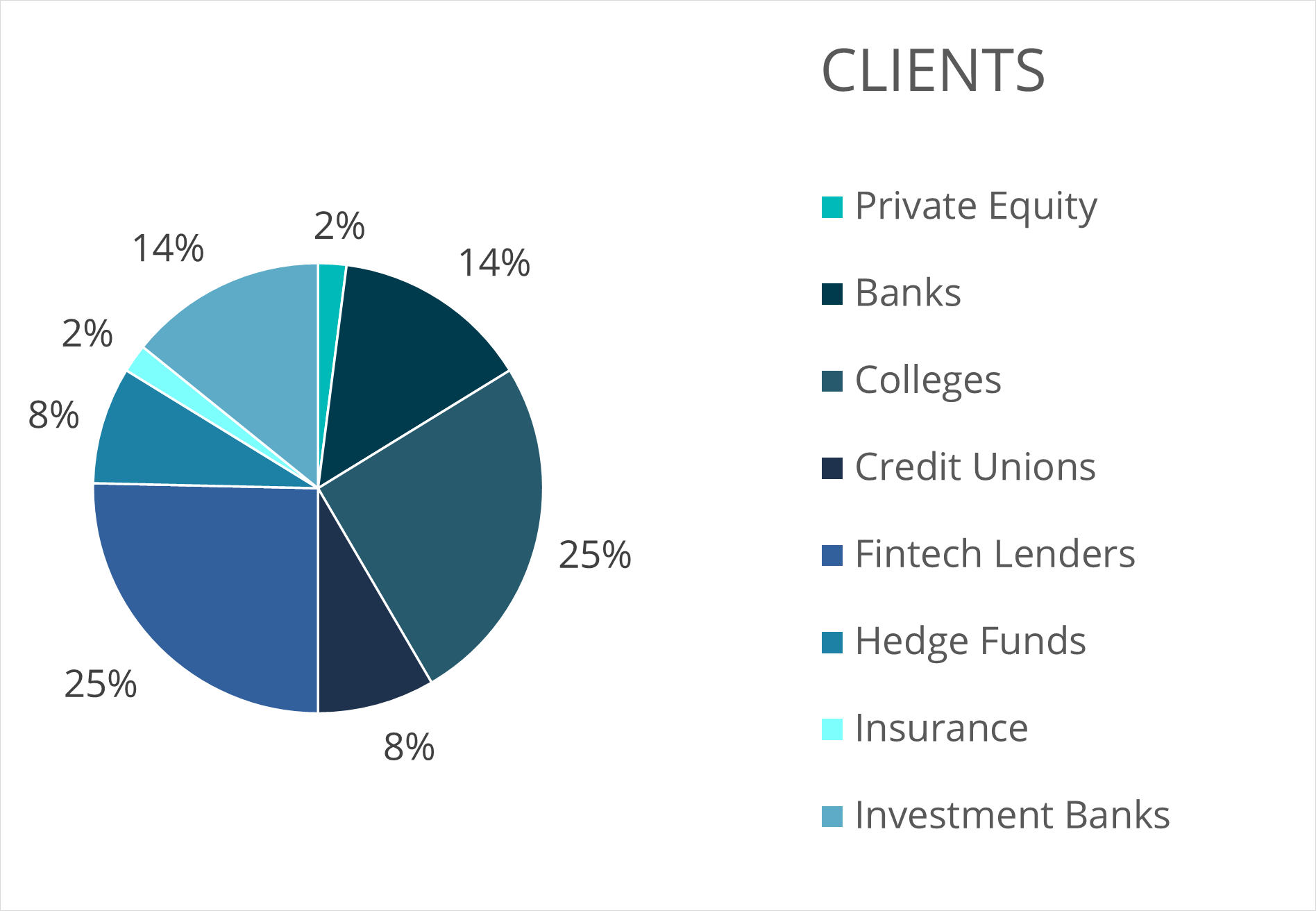

Client Types

why goal solutions?

differentiators

- Our team has a deep understanding of all aspects of the consumer asset classes that we serve

- Comprehensive solutions allow us to partner across all aspects of your programs

- Experienced Loan Servicing team, cloud hosted, API enabled proprietary platform, fully compliant and rataing agency approved

- Our innovative team and technology support markets where there are opportunities for strong growth and innovation

- Flexibile, scalable, and highly responsive – just ask any of our clients

- We seek out partners that deliver new solutions and who desire industry leading customer experiences and products

- Our reputation and reach in consumer finance markets allows us to bring multiple parties together as needed

experienced

compliance team

- Information Security Policy & Procedures/Oversight

- Data Governance

- Corporate Insurance and Bonding

- Company/HR Policies & Procedures

- State Licensing

- Contracting

- Litigation/Regulatory Inquiries

- Regulatory Updates Tracking

- Third-Party Vendor Management

- Loan Servicing System Quality Assurance

- Borrower and Servicer Complaints & Call Monitoring

- Third-Party and Internal Audits

- Regulatory Change Management

- Company Employee Training

”Response time on requests has been great, and there is always a willingness to find a win-win solution.

Fintech

let’s

get in touch

Connect with our subject matter experts to ask a quick question or schedule time for a more in depth discussion of your needs and our capabilities.