Lucidity, developed by Goal Solutions, is an innovative analytics platform designed to empower investors, originators, banks, credit unions, and colleges who have a need for enhanced data visualization and transparency. Drawing on CEO Matt Myers’ expertise in data science, Lucidity enables insightful, user-friendly visualizations and metrics in under 30 days while eliminating the need for internal investments in data engineers, data scientists, and other supporting resources at a potential annual savings of over $1 million. Below are the standout features and benefits for potential platform participants.

Lucidity Key Features and Benefits

Collateral Performance Module

Key Features:

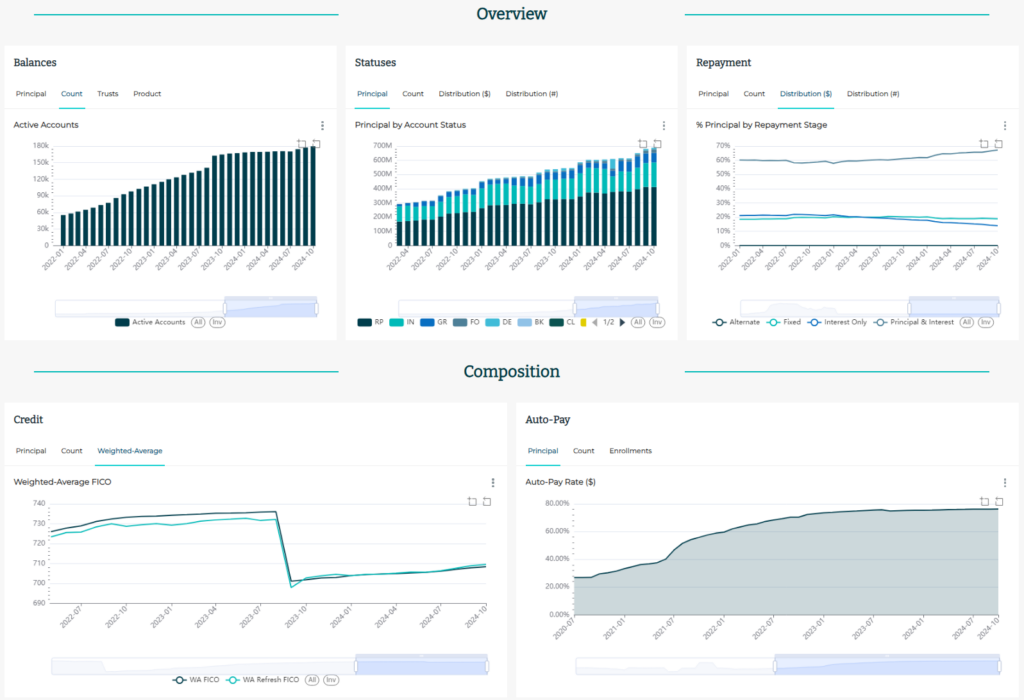

- Handcrafted Analytics: Developed by industry experts, Lucidity offers cutting-edge metrics and visualizations that we utilize in our own portfolios. Effortlessly manage performance, monitor activity, and uncover critical insights.

- At-a-Glance Insights: Gain immediate insights into your portfolio’s performance and activity with essential industry-standard metrics such as balances, delinquency rates, customer payments, and losses.

- Flexible Dashboards: Get a comprehensive view of your portfolio while retaining the ability to drill down into key trends with filters, zoom options, and multiple views for each metric, allowing for in-depth analysis of focus areas.

- Intuitive Data Visualization: Experience immersive, interactive charts and graphs that enable users to quickly identify trends, compare investments, and drill down into specific metrics.

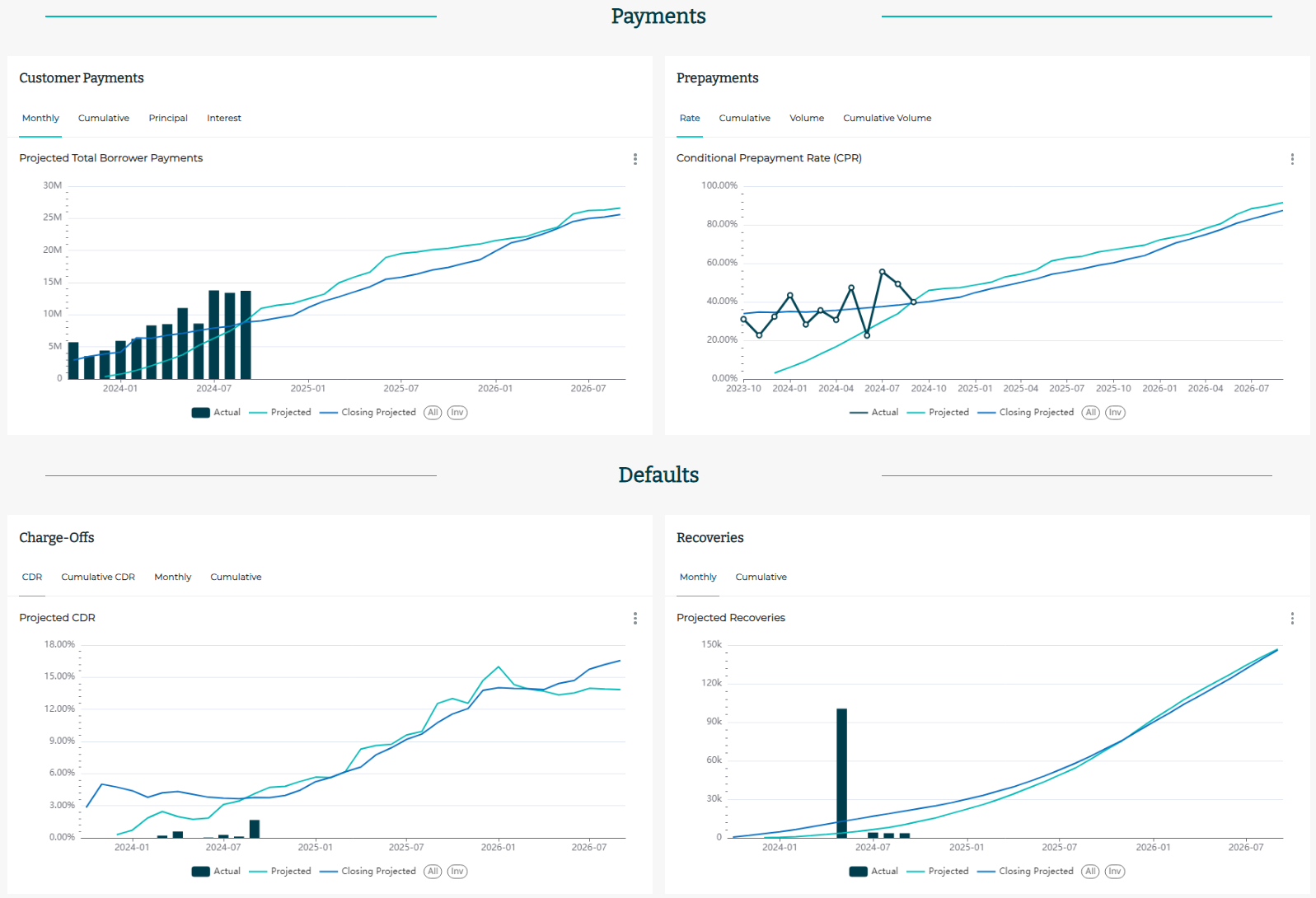

- Detailed Loan and Payment Tracking: Monitor borrower payments monthly, including breakouts for historical trends on principal and interest components.

- Comprehensive Delinquency Insights: Analyze delinquency data across various portfolios, track different delinquency stages, and gain insight into key performance drivers.

- Debt Layering Module: Enhance your analysis with our add-on option for warehouse and securitization overlays, allowing for tracking of time-sensitive metrics like concentration limits, triggers, parity ratios, and more, with color-coded indicators to highlight potential risks.

- Comparative Analysis Tools: Easily layer in the most relevant data points for your portfolio, enabling quick comparisons and evaluations of anomalies across different trusts, vintages, asset classes, and products.

- Sophisticated Filtering and Drill-Down Capabilities: Filter data across various metrics, portfolios, and time periods, allowing for a focused analysis on areas that require attention.

- Insights in a Box: Leverage our decades of loan management experience with our “Insights in a Box” option. Receive user-friendly, proven visualizations and metrics in under 30 days, eliminating the need for internal investments in data engineers, data scientists, and other supporting resources.

- Insights Outside of the Box: Opt for bespoke, custom-built dashboards tailored to your specific needs. Start from scratch or customize existing templates to meet your unique requirements.

- Data Normalization: Say goodbye to messy data. Our extensive experience with various servicers and platforms ensures our data normalization process transforms incoherent noise into actionable insights. ensures that our add-on data normalization process can turn incoherent noise into actionable insights.

Benefits:

- Proactive Management: Lucidity prevents unpleasant surprises by enabling clients to stay ahead of potential issues regarding eligibility and cash flow impacts.

- Enhanced Transparency: With improved access to essential metrics, clients can feel more secure in their decision-making processes, ultimately leading to better financial outcomes.

- Informed Decision Making: The platform’s extensive metrics and reporting features provide a holistic view of portfolio health, allowing clients to make well-informed decisions quickly.

- User-Friendly Experience: Designed for maximum information intake with minimal effort, Lucidity’s intuitive layout reduces the learning curve for users and boosts overall engagement.

As originally conceived, Lucidity is uniquely positioned to transform how clients track, analyze, and manage their portfolios, ensuring a comprehensive understanding of portfolio performance while minimizing risk. With its combination of cutting-edge data visualization, customizability, and proactive management capabilities, Lucidity stands out as an essential tool for today’s deeply data driven clients.