OPENING THOUGHTS

Crazy how much can change in a month, especially given the last 13 months have felt like one long groundhog day. Last time I wrote a newsletter I had visions of vaccines and outdoor baseball. Fast forward to today I am vaccinated, have been to a handful of Padres games including getting back to my opening day streak and San Diego has moved into the orange tier (for those that don’t know the CA tiering system that is a good thing!); in my ambitiousness I even bought tickets to an indoor concert in early November! I would have shorted everything I just said if you had given me the option last month

It’s not just my personal life opening back up. We actually had 3 people go to a, wait for it…conference this week. Now they had been pushing to go to the conference in conjunction with us going public with our new collection agency (shameless plug) and basically had to sign waivers like those extreme sports waivers that say if anything happens for any reason whatsoever it’s your own fault, but hey baby steps back to normalcy.

So it feels to me that while we still have the challenges associated with reopening after such a long time that I wrote about last month, and the associated what I think are foundational changes to work that have come out of COVID and will persist going forward, that the race back to life as we knew it is starting to heat up. We are eyeing 7/1 as a formal re-opening of our San Diego office and after moving at least 6 other dates we had targeted previously this one feels like it might stick. Hopefully, I am not jinxing things by writing this and booking indoor concert tickets…

Stay safe, get vaccinated, hopefully see you soon.

Matt Myers

President

Consumer Loan Markets

Say what one wants about the long-term ramifications of all the government support, it sure seems to be doing the trick today.

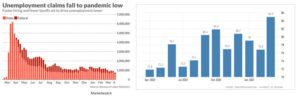

Recently unemployment claims reached the lowest level since COVID started. Still significantly above pre-COVID levels but definitely trending in the right direction and seemingly picking up momentum as the economy looks to accelerate the pace of re-opening. With the employment picture improving, vaccinations continuing and consumers knowing more stimulus is coming their way confidence has spiked.

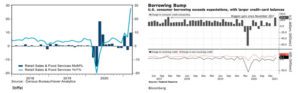

As confidence has grown consumers have both started spending and also borrowing.

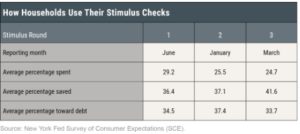

Translating all that good economic news to the lending space, consumers are still using stimulus money in productive ways with over two-thirds going towards paying down debt and saving.

Translating all that good economic news to the lending space, consumers are still using stimulus money in productive ways with over two-thirds going towards paying down debt and saving.

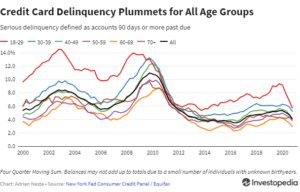

With the focus on doing responsible things with taxpayer money, and also (at least in CA) still being relatively constrained on being able to spend money on other (normal) things, loan performance remains strong.

With the focus on doing responsible things with taxpayer money, and also (at least in CA) still being relatively constrained on being able to spend money on other (normal) things, loan performance remains strong.

Credit card delinquency rates are at or near 20-year lows across age groups.

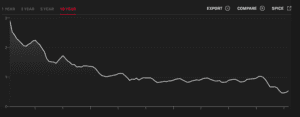

Also in the longer view vein the S&P/Experian Consumer Credit Default Composite Index is tracking towards the low end of the last decade. All that good news has flowed through to banks with several releasing billions in reserves set aside to cover what was expected to be a wave of defaults.

Also in the longer view vein the S&P/Experian Consumer Credit Default Composite Index is tracking towards the low end of the last decade. All that good news has flowed through to banks with several releasing billions in reserves set aside to cover what was expected to be a wave of defaults.

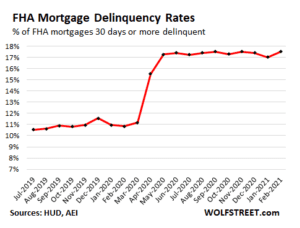

While the broad-based performance metrics look strong there are still some watchlist areas. Mortgage delinquencies have remained at or near historically high levels and while the CDC has extended the eviction moratorium there has still been an uptick in foreclosure filings signaling some trouble in the future, a dynamic the CFPB has been very focused on.

While the broad-based performance metrics look strong there are still some watchlist areas. Mortgage delinquencies have remained at or near historically high levels and while the CDC has extended the eviction moratorium there has still been an uptick in foreclosure filings signaling some trouble in the future, a dynamic the CFPB has been very focused on.

Another watchlist area is not shockingly subprime. While lots of metrics are showing historically low levels of delinquency subprime auto is basically the inverse and as a result Fitch has put the entire sector on watch.

Another watchlist area is not shockingly subprime. While lots of metrics are showing historically low levels of delinquency subprime auto is basically the inverse and as a result Fitch has put the entire sector on watch.

Regulatory

Another very busy month on the regulatory front as the current environment becomes reflective of the new administration’s priorities. Nothing very surprising except for maybe the speed of movement.

Operation Rollback Trump continued at the CFPB. The Bureau followed up the rollbacks I talked about last month by rescinding flexibility that had been provided to financial institutions in the wake of COVID around certain filings and compliance. Next was a rollback of the removal of the ability to pay standard in the payday lending space. Payday lending is a tough landscape and one we would never get into. The consumers it serves have very limited access to credit so the lenders serve a definite need but the combination of the collateral performance, small dollars and short duration makes it hard to structure products that don’t look predatory. I don’t envy the regulators who are trying to protect consumers but also not cut off their access to the little liquidity they can get.

Then the CFPB did something that I forecasted last month, pushing back the implementation of the revamped FDCPA form later this year to early 2022 to ‘give affected parties more time to comply’. Here is another forecast: they will remove certain provisions that have been claimed to be friendly to the debt collection space. Regardless of if you think the FDCPA changes are borrower or collector friendly (truth is they are both depending on which provision you are talking about) ignoring digital communications and not modernizing the FDCPA to reflect the way the world has changed since it was written over 40 years ago seems like it will ultimately harm both consumers and collectors alike in the long-run.

Beyond rolling back Trump initiatives the bureau made lots of ‘suggestions’. Financial institutions and collectors were encouraged to let stimulus checks get to consumers. Mortgage services were told to be flexible with homeowners, per my note above about their concern for the potential increase in foreclosures. That same focus on foreclosures showed up in a proposed rule to create a new pre-foreclosure period which would effectively forestall anybody from losing their home until well into 2022.

There were substantial regulatory developments outside the CFPB. The Senate saw the introduction of a CRA aimed at invalidating the OCC’s True Lender Rule while the ink is still drying on it. This would throw the true lender dynamic back into chaos which could have a substantial impact on sectors of consumer finance that rely heavily on bank partnerships, such as personal loans.

At the highest level of the judiciary SCOTUS finally issued a decision on the autodialer split and it is being viewed widely as a win for those who use them given the narrow definition the court applied to ATDS.

Lastly data privacy at the state-level continues to be all the rage with Alaska, Colorado and Arizona all rolling out bills.

Random Stuff

During the pandemic people have had lots of time to take up new hobbies. According to a LendingTree study those hobbies were financed by credit card debt.

Consumer payment hierarchy is something I have been fascinated with going back to my days in credit risk, all lenders should know where they sit in terms of the wallet hierarchy. So I found this data from TransUnion showing the implied relationship between cards and personal loans for borrowers who have both really interesting.

It has been exciting times in student loans. DOE is back in the saddle halting any collections efforts on charged off loans and cancelling 40k loans for disabled borrowers who lacked documentation. The FTC is sending out $50mm to 147k affected University of Phoenix students following the usual for-profit college set of allegations around deceptive marketing. And for those who missed the CEOs of Navi and PHEAA getting a tongue lashing in a highly partisan hearing in front of a totally inappropriate committee (but it is the committee Warren chairs) I’d recommend at least reading the highlights. It makes me so happy we have always run the other direction when it comes to servicing federal student loans, you could not pay me enough (and the job pays very little).

We want to hear from you. We’ve got a quick two question survey to learn more about your thoughts on growth in consumer assets and which asset segment will start to deteriorate first. Please take a minute to answer this survey and we will share responses in the next newsletter. Thanks.