OPENING THOUGHTS

Time to start planning for the return to not quarantine!

While San Diego seems a bit on the slow end of the vaccination spectrum the fact that the Padres are dropping my season tickets into my account this Friday is encouraging. Ignore the fact that I don’t know which games I will get or which seats I will be sitting in, getting back to Petco Park is probably one of the things I have missed most during COVID especially because the Twins were supposed to make their every 6 year stop last season. The Padres are generally terrible but of course, the one season fans couldn’t see them live they were great, hopefully, they can keep it together this season and not regress back to the mean. Regardless of the quality on the field, you can be guaranteed the quality of beer and food along with the weather is second to none in MLB.

Not knowing which Padres games or seats one will get until the tickets show up seems like a representative example of what the return to normalcy (probably not exactly the right word but you get the point) will look like, moderate degrees of certainty sprinkled with varying portions of surprise and making it up as we go along. A work-related example, in the last year we have grown so much that the current office space no longer accommodates all the employees in one of our businesses. So while we know people will be coming back at some point, and we are pretty sure they will come back to the old space, to accommodate in the short-term we will have to likely utilize some hoteling of the workspaces and staggard schedules. Definitely a good problem to have and a symptom of the growth and success we have had, but also an issue that if we were in the office the entire time would not have crept up on us as it did.

Padres tickets and outgrowing our office space might be unique to us but there are lots of things we will be sorting out along with the rest of the business world. What to do about people who think they should be able to come into the office less? What about those who never want to come back to the office and want to move to a different state? While I can appreciate companies like Facebook, Google and Spotify might decide to let their employees do whatever indefinitely, as we have looked inwards at our business and what works best for us I think we have decided that model is probably not the best fit for our company. However, labor markets are efficient so while we can do whatever makes sense for our company we do have to be cognizant of what others are doing to protect our most valuable asset, our people. We spend lots of time thinking, reading, studying, and discussing options and I think we are pretty well prepared, however, I know that it is going to be a fluid situation; we will need to be flexible, or risk seeing what happens if we are not.

I share all of that because at one point in time I (probably naively) just assumed the world would just go back to how it was once COVID had been dealt with like somebody hit the pause button and we could just resume things as they had been. As the world starts to inch towards opening back up I keep getting the reminders that be they short term disruptions like my Padres seats, medium-term dynamics like the hoteling of workspaces while we sort out the right space planning model for the future, or the long term dynamics like allowing more remote work, there are lots of decisions that need to get made for us all to find the right fit for what the world and our industries have evolved to over the last 12+ months.

Good luck and can’t wait to see everybody at a conference or on a road trip soon! If you come to San Diego the Padres game is definitely on me.

Matt Myers

President

Consumer Loan Markets

Good times keep rolling, and with the new stimulus bill coming to fruition it appears that the performance tailwinds should continue for most of 2021. Good (more like great) news for some, a disappointment for others. Not a lot to report on in terms of loan performance that isn’t a continuation of what I have written about in prior months, but I’ll touch on some updated data briefly.

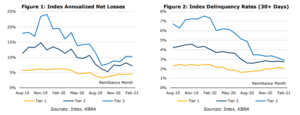

Continuing my trend of tracking Marketplace Loans through the Kroll reports, while there has been some slight elevation of loss rates recently, they remain well below pre-COVID levels, and with delinquency rates still low the depressed charge-off trend should continue.

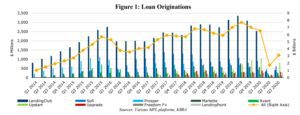

Despite all of the strong performance of 2020 originations were generally down across the board as originators tightened their underwriting boxes and demand was reduced with less spending driven by stay-at-home orders. Sticking with data from our friends at Kroll, most Marketplace Lenders saw volumes decline sharply in Q2-Q3…

Despite all of the strong performance of 2020 originations were generally down across the board as originators tightened their underwriting boxes and demand was reduced with less spending driven by stay-at-home orders. Sticking with data from our friends at Kroll, most Marketplace Lenders saw volumes decline sharply in Q2-Q3…

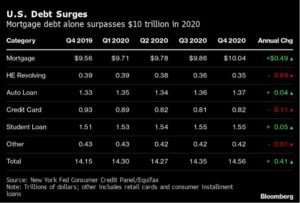

…But according to TU volumes in a variety of asset classes began to pick back up in Q4 and mortgages have continued to get originated at a rapid clip which pushed consumer credit as of the end of 2020 to the highest level ever despite consumers paying off $83b in credit card debit in 2020.

…But according to TU volumes in a variety of asset classes began to pick back up in Q4 and mortgages have continued to get originated at a rapid clip which pushed consumer credit as of the end of 2020 to the highest level ever despite consumers paying off $83b in credit card debit in 2020.

Now onto the dark storm clouds part of the program.

Now onto the dark storm clouds part of the program.

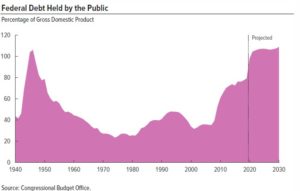

Polls continue to indicate that significant portions of consumers have not recovered their earnings from the COVID impact. Their stable footing appears singularly tied to the government support, doesn’t feel like a sustainable dynamic especially with the already massive increases in government debt.

The housing market that we touch on each issue seems like it should be cause for concern. Data continues to show that even with the ever-extending forbearance policies in place there are millions of people seriously delinquent on their mortgages and the new head of the CFPB has been sounding the alarm about a potential foreclosure crisis. But I have harped on the housing market risks in prior editions so don’t want to spend too much time on that dynamic.

The housing market that we touch on each issue seems like it should be cause for concern. Data continues to show that even with the ever-extending forbearance policies in place there are millions of people seriously delinquent on their mortgages and the new head of the CFPB has been sounding the alarm about a potential foreclosure crisis. But I have harped on the housing market risks in prior editions so don’t want to spend too much time on that dynamic.

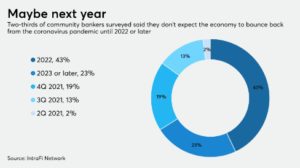

All of these concerns have led to attorneys forecasting a wave of consumer bankruptcies when the government propping up ends, and bankers remain pessimistic about the ability of the economy to recover from COVID. So, love or hate government stimulus it does feel like the wall holding back a wave of consumer distress that would materially impact loan performance.

Regulatory

Regulatory

These days it feels like given the lack of excitement around loan performance and the excess excitement on the regulatory front I should start the newsletter with this section.

While Rohit’s confirmation hearing was not as action-packed as it could have been, although it was close, he did provide some insights into where the Bureau will focus, at least initially (note: I am assuming he gets confirmed). Not shocking he talked about the CFPB being more aggressive in terms of enforcement and called out mortgage servicing, credit bureau reporting, the student loan world and fair lending as specific areas of interest.

The CFPB has been getting a head start on some of the areas that Rohit called out even in advance of his confirmation issuing statements around ECOA (seemed like a statement of the obvious to me, but it’s a headline). They are also ramping up attorney hiring inside enforcement including pulling from other federal agencies, which they might need if they end up taking on the FTC’s historical role regulating fin tech marketing.

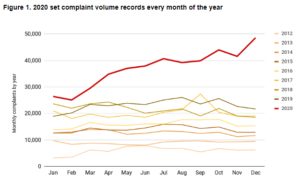

Maybe most impactfully, and in a signal of what might be to come, the CFPB postponed a much anticipated revamping of the QM definition and extended the non-QM patch, and then followed that up with the reversal of a UDAAP policy that the Kraninger CFPB issued. Is this a sign of more unwinding of Trump CFPB initiatives such as the new debt collection rule slated to go into effect in November? Feels like a coin flip at this point. But is it not all unicorns/hiring sprees and rainbows/undoing Trump era initiatives at The Bureau. They recently lost in District Court against Ocwen and there is another case out there challenging a fundamental premise of the CFPB, this time around the funding mechanism and lack of checks and balances. One thing is for certain, given the record complaints the CFPB took in during 2020 the forecast calls for CIDs.

There is a regulatory world outside the CFPB. The FTC is also announcing their priorities under the new Administration, not surprisingly it includes data privacy. Speaking of privacy, Virginia recently became the second state to pass its own consumer data protection legislation; nationwide companies will put this in whatever category as it is less restrictive than California’s which is already in effect so needs to be adhered to.

There is a regulatory world outside the CFPB. The FTC is also announcing their priorities under the new Administration, not surprisingly it includes data privacy. Speaking of privacy, Virginia recently became the second state to pass its own consumer data protection legislation; nationwide companies will put this in whatever category as it is less restrictive than California’s which is already in effect so needs to be adhered to.

Navi took an L in Washington State Court and now got hit with a shareholder class account suit, their GC must be a busy person.

In the category of making debt collections harder, T-Mobile is blocking debt collector texts. I wasn’t aware that cell phone companies made laws…

One legislative thing to touch on is the inclusion of a provision in the most recent stimulus package that makes student loan debt forgiveness non-taxable. In the near term, this should have a positive impact on flexibility as larger balance loans can be settled and modified without borrowers getting stuck with a huge tax bill. But in the larger political chess game, this sets the table for broader loan forgiveness if they can manage to get it done.

Random Stuff

In a resume move you don’t see too often, the former head of Goldman’s Marcus group is heading up Walmart’s fintech efforts.

SPACapalooza continues with the ever-creative Mike Cagney spinning up his own to fund potential acquisitions.

SoFi from de novo bank to acquirer of existing bank. Might be the highest ratio of the equity value of acquirer to the size of the bank being acquired of all-time.

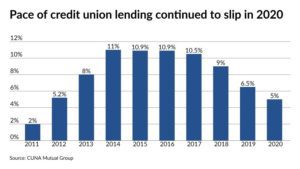

Credit Unions and their large debt-averse membership put the brakes on borrowing and stashed cash during the pandemic:

- Membership growth is the slowest in years

- Overall lending in 2020 dipped to a low not seen since 2012…with first mortgages now making up 33.7% of all loans – the highest level in Credit Union history

- Credit Union Deposits closed out the year with a 20.6% increase, more than double the 8.2% lift seen in 2018