Welcome to the Inaugural Edition of the Goal Solutions Newsletter!

The consumer lending landscape is an ever-changing one, especially these days. Across collateral performance, the regulatory environment, credit markets, and just general innovation, there is a lot to keep track of. At Goal, consumer lending has been our focus over the last two decades, and in addition to being active participants in a variety of ways and teachers inside the industry, we are also students of it. In our pursuit of consistently staying on top of things, we come across numerous articles about our sector and we thought that our partners would find them at a minimum interesting and at a maximum relevant and useful. If you are getting this newsletter it is because we have interacted with you in some capacity believed you would appreciate and hopefully benefit from the content; if we are wrong my sincere apologies, please just hit the ‘unsubscribe’ button and we will spare your inbox.

Hope you enjoy it!

Matt Myers

President

OPENING THOUGHTS

The consumer lending purgatory we are currently in is truly a fascinating one. On the one hand across the various secured and unsecured portfolios we manage cash flows have been mostly stable(ish) with delinquency rates approaching or touching all-time lows, be it auto, unsecured installment, federal and private student loans, or others, where postponements are available.

On the flip side, the primary driver of the lower delinquencies is the easy availability of short-term postponements, which has 10-30% of the loans (depending on the credit quality of the underlying borrowers) not being required to make any payments. Most of those postponements were taken out from mid-March to mid-April, and while some of the borrowers have begun to emerge from the postponements the vast majority are still in their initial postponement or have taken out a subsequent one. As the availability of the postponements becomes exhausted and the stimulus as well as enhanced UI that has created a situation where half of those unemployed are earning 2x what they were earning prior to being laid-off dries up, assuming we still have $40mm+ people unemployed, it has the potential to create some meaningful upward pressure on delinquency rates as we move through Q3/Q4 and into 2021.

There are a lot of people trying to figure out if we are going to see a V-shaped recovery or something more like the Nike swoosh; another outbreak of COVID as we try to open and see cases increasing could create a double-dip. The shape of the dip will drive consumer loan performance over the short and medium-term and has all sorts of implications for originators, lenders, investors, servicers, collection agencies, and others. I definitely don’t claim to have that answer, if I did I probably wouldn’t be writing this newsletter😊. But I do know that regardless of the outcome we’ll probably be talking about it for years to come.

Loan Performance

While consumer loan performance continues to hold up well from a delinquency perspective there are some indicators of challenges in the housing market, especially among renters.

Continuing on the theme of examining where the COVID impact is largest, some interesting data from TU on the generational and demographic dynamics.

An expanded view of measuring the impact of COVID on labor markets shows that the impact could be larger than what we see in the unemployment rate.

Regulatory

While the OCC provided some welcome Madden Guidance to the markets via rulemaking, there continues to be a conflict with the states as the recent Colorado ruling demonstrates.

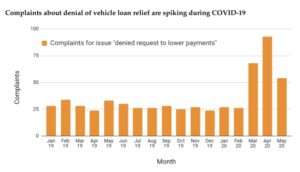

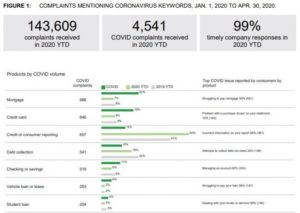

On the consumer protection front, the CFPB continues to see a record number of complaints since COVID began, with it being particularly pronounced in auto.

The much-anticipated California CFPB is facing a more uncertain future in the wake of budgetary pressures, for now…

With the end of LIBOR approaching faster than most of us (probably including AARC) would like, the CFPB took some steps to layout some guidance around Reg. Z and how it should be translated into the new APR (‘substantially similar’). I tend to think the more guidance the merrier given all the uncertainty.

Industry Specific

In the student loan world, Direct Loan borrowers are going into repayment 10/1 ready or not (both borrowers and the labor market).

Speaking of federal student loans, FSA made a surprising set of selections (at least to me) around the future of Direct Loan servicing, icing out NelNet/Great Lakes, AES, and Navient; net of this the forecast calls for lawsuits.

While there have been historically high levels of postponements in most of the consumer loan space, there have been some exceptions. Residential solar loans continue to see strong reception in the capital markets while improvement demand has remained resilient driving new home improvement originations.

In the auto world, fear about future defaults has caused one of the largest lenders to pull back their lending activities.