OPENING THOUGHTS

Another month working from the dining room table, and another newsletter!

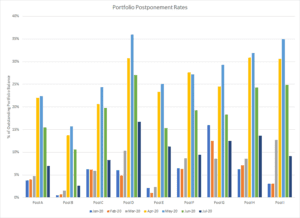

Operation Return to Repayment has commenced. Postponements for most of the portfolios that we manage began to really ramp up in mid-March and continued through mid-April. Following the 90-day payment suspension (the most common duration we saw) the first batch of borrowers exited their postponement status in Mid-June and with the 30-day grace period had their first payment due in mid-July, and the rest will roll out of their first postponement up through mid-August. I’ve included some sample pools from our investment portfolio to illustrate what we are seeing, a 5-10% drop in postponements from 5/31 to 6/30.

So far the result has been largely what we expected. Material numbers of borrowers requested an extension of their postponement, while the rest have gone into repayment ready or not. Of loans that have gone into repayment we have seen delinquency rates range 20-30%, so clearly, a population feeling the stress.

So far the result has been largely what we expected. Material numbers of borrowers requested an extension of their postponement, while the rest have gone into repayment ready or not. Of loans that have gone into repayment we have seen delinquency rates range 20-30%, so clearly, a population feeling the stress.

But this feels like just the start. With enhanced UI slated (at least currently) to end this weekend, the economic re-opening going in reverse, future stimulus checks up in the air (although as of writing this seems like one more $1.2k check will get done, income threshold TBD) and monthly obligations from student loans to mortgages resuming, household cash flows will likely feel more pressure and it seems unlikely that consumer loan delinquency rates can remain unimpacted.

So with all that excitement, I’m going to do the unthinkable, I’m getting on a plane to go somewhere next week. Then I’ll get back and sort through July month-end data…Stay safe!

Matt Myers

President

Loan Performance

As expected and noted in the Opening Thoughts with borrowers exhausting their initial postponement allotments forbearance rates are beginning to come down across asset classes, for better or worse…

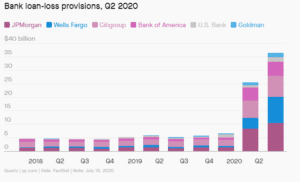

…But in the category of a picture being worth a thousand words if recently reported bank loan loss reserve numbers are any indication the market is voting more worse, less better.

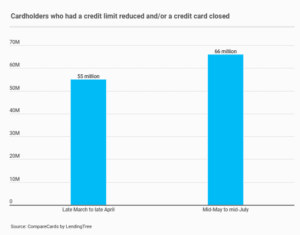

And it is not just the banks who are preparing for the worse, as evidenced by 66 million people having their credit cards closed or limits reduced in the last two months, bringing the total to over 110 million reductions or closures since mid-March.

And it is not just the banks who are preparing for the worse, as evidenced by 66 million people having their credit cards closed or limits reduced in the last two months, bringing the total to over 110 million reductions or closures since mid-March.

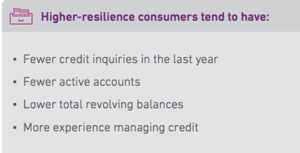

To help navigate the uniqueness of the current landscape FICO has rolled out a Resilience Index specifically designed to predict repayment risk during economic downturns. From my old credit risk modeling days, the inputs looks like a bankruptcy score (lower utilization rates, fewer inquiries, less active accounts, etc.).

To help navigate the uniqueness of the current landscape FICO has rolled out a Resilience Index specifically designed to predict repayment risk during economic downturns. From my old credit risk modeling days, the inputs looks like a bankruptcy score (lower utilization rates, fewer inquiries, less active accounts, etc.).

Regulatory

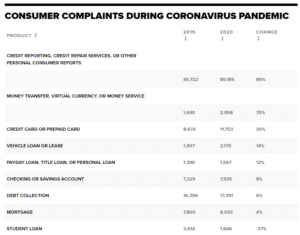

While the SCOTUS ruling invaliding the CFPB leadership structure is old news by now, that has not stopped the Bureau from pushing forward on several fronts. Most notably for the broader consumer lending space is the much anticipated (and long in the works) October finalization of the debt collection rulemaking. Also of note is the contemplated expansion of the QM definition, although completing eliminating the DTI requirement seems a bit ambitious. Lastly in CFPBland, COVID-driven compaints keep coming driven by a near doubling of credit bureau-related complaints, which was already the most complained about the area.

One more interesting SCOTUS ruling was the elimination of the long-standing exemption from the TCPA which allowed robocalling on government-owned or backed debts. I’m personally surprised it took this long for it to happen given the volume of robocalling complaints that are generated.

One more interesting SCOTUS ruling was the elimination of the long-standing exemption from the TCPA which allowed robocalling on government-owned or backed debts. I’m personally surprised it took this long for it to happen given the volume of robocalling complaints that are generated.

On the always exciting LIBOR replacement front, AARC issued a guide to some of the tactical aspects of the movement to a new index rate as well as some suggested fallback language for private student loans; now if they could just fix that whole legacy asset LIBOR transition issue it would be much appreciated…

Random Stuff

After the ILC initiative started and stopped SoFi is going the de novo bank route. From my experience with bank charters, bring lots of paperwork and take the over on timing.

Continuing the trend we noted last month, residential solar loan deals continue to get done with LoanPal the latest to head to the ABS markets.

As most of you know we do a lot of work in the debt collection space and manage numerous agencies. So it was interesting to see something that we have observed quantified in this survey of debt collectors. Not shockingly the agencies that invested in technology pre-COVID were able to respond more quickly and effectively, turning what for a lot of agencies a material challenge into an opportunity.

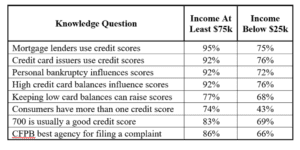

Some interesting (although probably not shocking) insights about credit education levels among different income ranges. The punchline is that those who request credit the most are the least informed, not exactly a recipe for success.

Student loan refi lender volume forecasts tied to AY 20/21 in-school originations just took a hit as Direct Loan rates recently reset at historically low levels for undergrad and grad students. Undergrad rates at 2.75% fixed? My daughter is only 6 months old but I’m going to see if she can enroll in the fall at these prices, it’s all online anyways in California so I can help with the coursework…

Student loan refi lender volume forecasts tied to AY 20/21 in-school originations just took a hit as Direct Loan rates recently reset at historically low levels for undergrad and grad students. Undergrad rates at 2.75% fixed? My daughter is only 6 months old but I’m going to see if she can enroll in the fall at these prices, it’s all online anyways in California so I can help with the coursework…