OPENING THOUGHTS

As we head into what is expected to be a hectic election season, and as my fantasy football team has been thrown into chaos by injuries, things remain relatively tame on the consumer loan front.

I have been reporting the last few months that while still slightly elevated COVID-driven postponement levels are coming back down to more normal levels across the portfolios that we own and manage in student loans, personal loans, home improvement and residential solar. Of the loans that had a first payment due in July or August ~75% of them have made that first payment, indicating that as borrowers are transitioning back to resuming their monthly payments most are doing so successfully. Don’t get me wrong 1 out of 4 people not making their first payment is obviously not a great statistic, normal roll rates into the 1-30 bucket are more like 2-5% depending on the underlying credit quality of the pool, but we are still very early and typically 80%+ of the borrowers who land in the 1-30 DPD bucket ultimately cure. Assuming these borrowers perform like the general population (which might be a misplaced assumption) and most of the first-pay delinquencies ultimately cure I think most lenders would consider the postponements as a temporary reprieve a success. If they don’t cure at the 80%+ rate on the other hand…

When you read the Loan Performance section you will see that what we are experiencing is consistent with the broader consumer loan market. Low delinquencies that came about during Q2 with the expansive use of postponements is making its way through to charge-offs, which are coming in at historically low levels in a variety of asset classes. Reduced charge-offs will likely persist for all Q4 while the low inventories sitting at the various delinquency stages roll through. And now we start to set the stage for Q1 2021 charge-off rates with the first post-forbearance cohorts moving back into repayment. If borrowers can’t get back on track making payments that will create delinquency bubbles which will flow through and result in elevated charge offs in Q1 and/or Q2, so we will be closing monitoring the earliest stages during the next few months. COVID borrowers are clearly an elevated charge-off risk, as we can already see with 25% missing their first payment, but the depth and duration of consumer loan portfolio performance challenges will ultimately be dictated by how quickly the labor market recovers. If unemployment recovers elevated CDRs should be largely contained to a quarter or two, if on the other hand unemployment continues to stagnate that would create the conditions for increased loss rates to persist for most of 2021 and potentially beyond.

Good luck with your portfolios and fantasy football, may the waiver wire be with you.

Matt Myers

President

Loan Performance

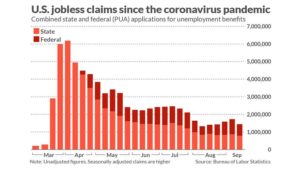

While people (present company included) think it is only a matter of time before the elevated unemployment rate takes a toll on consumer loan performance, the combination of payment assistance from lenders and governmental support has us defying gravity so far. One outcome is that while it might just be on paper, household net worth has spiked up so consumers should feel flush. However, as we all know congress has (shockingly) struggled to get their act together, which could jeopardize the consumer loan stability and the equities markets which are driving the net worth dynamic.

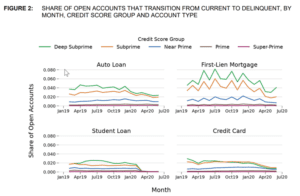

A recent study from the CFPB shows that across asset classes and credit segments performance improved during Q2.

A recent study from the CFPB shows that across asset classes and credit segments performance improved during Q2.

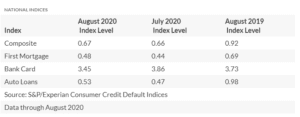

Reduced delinquencies in Q2, largely driven by postponements, flowed through to lower charge-off rates in Q3, as recently noted by Fitch resulting in improved performance in credit card ABS. And lower defaults in August were also called out in a recent S&P/Experian Consumer Credit Default Indices publication.

Reduced delinquencies in Q2, largely driven by postponements, flowed through to lower charge-off rates in Q3, as recently noted by Fitch resulting in improved performance in credit card ABS. And lower defaults in August were also called out in a recent S&P/Experian Consumer Credit Default Indices publication.

Even as enhanced UI is pulled back and deferments begin to expire performance has still held up for some issuers such as Capital One and BofA. And mortgage forbearances have begun to decline as the employment market has started to recover, even though there is a looooooooong way to go still.

Even as enhanced UI is pulled back and deferments begin to expire performance has still held up for some issuers such as Capital One and BofA. And mortgage forbearances have begun to decline as the employment market has started to recover, even though there is a looooooooong way to go still.

And all this (perceived or actual) great performance is keeping the markets moving forward. Issuers of personal loan-backed ABS are issuing again and auto lenders are seeing an increase in credit extension as auto sales are rebounding. Although a recent survey of banks indicated that overall loan demand is down with consumers spending less as a result of COVID restrictions and having liquidity via the government stimulus programs, but as noted it remains to be seen how long that lasts.

One area that, probably not surprisingly, is starting to show some cracks is subprime auto. This is consistent with what we have seen as COVID has had more of an impact on people with traditionally more volatile credit.

Regulatory

Always lots of exciting regulatory developments.

After some starts and stops for budgetary reasons the Republic of California finally looks to have found a way to launch its own CFPB, coming to a compliance group near you in January 2021 for covered industries (which reads like basically any financial services company or lender). The creation of the Department of Financial Protection and Innovation (holding…tongue…) happens inside a larger bill that also includes licensing and other provisions centered around collections.

Meanwhile, the actual CFPB is getting to roll out the long-awaited debt collection rules in October, and staying busy in the interim by hitting Encore with a suit alleging that they violated their 2015 consent order with the claims centering around disclosures to consumers.

Going back to California for a minute, it was busy in the last month, the DBO is going after a title lender and their bank partner. Seems like true lender debate will go on in some way/shape/form forever and the state and/or federal level.

Random Stuff

PayPal is coming into the POS installment lending space. Given the success of PayPal credit in terms of leveraging the extensive payment network to drive volume seems like they should be able to have some good success on the installment side as well. It will be the battle of Max Levchin-founded companies with Affirm and PayPal.

Putting some firm numbers to a trend that we all know is occurring, from 2018 to 2019 non-bank lending in California increased almost 70%.

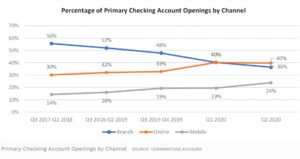

Sticking with the theme of evolving landscapes, here is an interesting look at the increasing digitization of banking, with online account openings exceeding branch-based for the first time in 2020.

For those of us who spend a lot of time in the student loan space the forgiveness of the ITT private loans that was recently announced was not much of a surprise, the only surprise was how long it took the AGs to get it done. And not to be outdone by other federal and state regulators, the FTC recently settled with the University of Phoenix involving not only debt forgiveness but also a cash payment.

For those of us who spend a lot of time in the student loan space the forgiveness of the ITT private loans that was recently announced was not much of a surprise, the only surprise was how long it took the AGs to get it done. And not to be outdone by other federal and state regulators, the FTC recently settled with the University of Phoenix involving not only debt forgiveness but also a cash payment.