OPENING THOUGHTS

Happy to report that I survived my first plane travel since ABS in Vegas back in February! Going back in the air next week for a longer trip back to my home planet of Minnesota. In the interim another newsletter to hopefully provide some useful information about the consumer lending space.

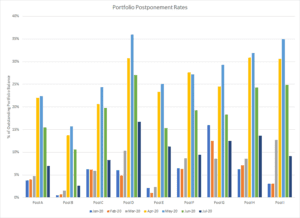

In the category of what goes up must come down, below is an update to the chart I included last month showing postponement levels in a sample of private student loan pools in our investment portfolio. Most borrowers took out their initial 90-day postponements in late March to early/mid-April, coming out of postponement in May/June with first payments due in July/August following a 30-day grace period. The result is that from 5/31 to 7/31 postponement levels fell by 50%+ from COVID highs with most portfolios we own being back in the single digits as of the end of July.

Delinquency rates have held up well so far, although August month-end numbers will be important as large swaths of postponed consumers had their first payment due. So far the majority of borrowers who have left deferment/forbearance have made their first payment making originators and current loan holders happy, distressed buyers disappointed. It feels like between the extension in deferments that have been granted, like all Direct Loans until 12/31, and the partial resumption of the enhanced UI, borrowers are still paying less bills with more money. Remarkably we had our highest post-default collections month of the year in July (summers are usually very soft), which we attribute to more liquid consumers and a delayed tax season. If the goal is a collective kicking of the consumer loan payment can down the road until the economy materially recovers it appears that goal has been achieved, albeit at a lower level as deferments get somewhat more restrictive and enhanced UI dialed back in terms of who gets it and the amount that they get.

Delinquency rates have held up well so far, although August month-end numbers will be important as large swaths of postponed consumers had their first payment due. So far the majority of borrowers who have left deferment/forbearance have made their first payment making originators and current loan holders happy, distressed buyers disappointed. It feels like between the extension in deferments that have been granted, like all Direct Loans until 12/31, and the partial resumption of the enhanced UI, borrowers are still paying less bills with more money. Remarkably we had our highest post-default collections month of the year in July (summers are usually very soft), which we attribute to more liquid consumers and a delayed tax season. If the goal is a collective kicking of the consumer loan payment can down the road until the economy materially recovers it appears that goal has been achieved, albeit at a lower level as deferments get somewhat more restrictive and enhanced UI dialed back in terms of who gets it and the amount that they get.

Skol.

Matt Myers

President

Loan Performance

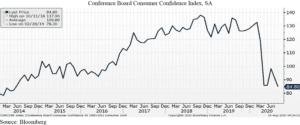

As the pandemic’s influence on the economy continues and given the widespread adverse impact that COVID has had on household income it is no surprise that consumer sentiment is and is expected to remain depressed.

Following the sentiment dynamic the financial sector is still on edge with institutions from banks (see the last newsletter), fintech, and even credit unions bracing for expected elevated delinquencies and charge-offs in the coming months.

Following the sentiment dynamic the financial sector is still on edge with institutions from banks (see the last newsletter), fintech, and even credit unions bracing for expected elevated delinquencies and charge-offs in the coming months.

With those dynamics driving the backdrop of expectations around loan performance it is not surprising to see banks wanting to be more flexible with borrowers and regulators encouraging workouts to be leveraged as a tool, a combination that has created a tidal wave of loans in deferment.

And as lenders are bracing for the impact of what happens when the deferments come out, in the case of banks exacerbated by CECL, not surprisingly lenders are tightening underwriting requirements for extending new credit.

Regulatory

As lenders look to find additional ways to underwrite consumers beyond FICO they are running into scrutiny from both the CFPB and Congres who are focused on the fair lending considerations associated with alternative underwriting. Having spent time looking at the predictiveness of educational data on loan performance, I can attest that it is hard to unwind the impact socioeconomic forces play and how those influence the outcomes of models that are built intentionally blind to the impact of protected classes.

On the CFPB complaint front, wait for it…Another record in July, primarily driven by credit bureau=based complaints.

The CA state CFPB that was previously nixed in June due to COVID budget pressures looks like it is making a comeback i the latest budget bill.

The CA state CFPB that was previously nixed in June due to COVID budget pressures looks like it is making a comeback i the latest budget bill.

The last state or federal CFPB point, the OG CFPB recently proposed a new type of qualified mortgage that is based on loan seasoning to encourage innovation in mortgage lending but also control for performance.

Providing some level of certainty on the true lender in a state where true lender has been a bit volatile, the Colorado AG settled with Web Bank and Cross River Bank . Not a perfect solution and comes with restrictions but definitely a positive development for lenders and their partner banks who lend to Colorado residents, especially those entities that warehouse and securitize.

Recent ruling allows Navient to be sued by both the CFPB and individual states concurrently on +/- the same issues over their servicing of federal student loans, not a great precedent.

Closing out the regulatory side a recent sixth circuit ruling deepends the rift around the definition of an autodialer under the TCPA. SCOTUS will be sorting this issue out next term; it will be a critical ruling given the broad interpretation some of the courts have taken on what constitutes an autodialer, which is basically every VOIP phone system used by servicers and collection agencies. Going back to rotary phones?

Random Stuff

I think pretty much all of the readers of this newsletter are in tune with the impact Current Expected Credit Losses (CECL) rules are having on bank loss reserves. A recent publication from Fitch highlighted the extreme impact CECL is having on student loan portfolios held by banks , with the median increase in associated reserves being 73% and as high as 100%+ for the most impacted banks (SLM, Ally).

While most of the focus around COVID on consumers has been focused on the near-term implications, the impact could have more impactful longer term for millennials accumulation of wealth.

While most of the focus around COVID on consumers has been focused on the near-term implications, the impact could have more impactful longer term for millennials accumulation of wealth.

Given the reduction and ultimate sunsetting (pun intended) of the solar ITC, it was only a matter of time until lenders moved to find other ways to differentiate their products. Mosaic is rolling out a 12-month no payments/deferred interest product. NPDI promos make the traditional home improvement world go-’round but have not shown up in solar until now. I also expect to see terms of 25 and 30-years to help reduce monthly payments to make for a more compelling value proposition.

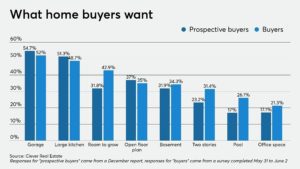

With homeownership at the highest level since 2008 and everybody stuck at home, it is not a surprise that home improvement demand is on the rise.