OPENING THOUGHTS

Happy New Year! I hope everybody had a good and safe holiday season and got to take some time off to relax with friends, family, and whoever else constitutes your bubble. After what was a crazy 2020 it is so nice to get off to an orderly, mundane and non-controversial 2021…

I’m excited for 2021, it is the year that life should get back to some semblance of normal. Not sure if that happens in April or October, and not sure how we’ll all end up defining ‘semblance of normal’ given what we have all gotten used to. But I do have faith I’ll get to leave the house and maybe even get to go to Padres games!

In 2020 we had to adapt. We couldn’t travel to our sites in other states to meet with the employees, so we used too much Zoom and Teams. We couldn’t go to conferences to meet with current and potential partners, so we used too much Zoom and Teams (sensing a theme here). But the net result of it all was that we tried lots of different ways to engage with employees and partners; we shot videos, did digital campaigns, were more focused on our branding and how we present ourselves because it was the only exposure we had to the market. Some of it worked really well, some of is failed miserably, regardless of the outcome we learned a lot and I’m excited to take those learnings from the zombie apocalypse back to the new world (that whole ‘if it doesn’t’ kill you it makes you stronger’ thing).

We even started a new business from scratch! I’m very bullish on the debt collection space, even with the changing guard in Washington. We had our best post-default recovery year ever in 2020 buoyed by postponements of payments on most obligations and the government support to borrowers. In 2021 either that cash will keep flowing from the taxpayer coffers and that will keep charge-offs down and defaulted borrowers cash flowing, or the support will cease and people will default creating more inventory, it is a win-win scenario if you are a debt collector. So we’re leaning into what we believe to be a favorable macro trend and two weeks from now our TCM Recovery Division goes live with inhouse collections on credit cards, student loans, personal loans, home improvement loans, cell phone bills, utilities, medical receivables and a host of others asset classes.

Selfishly I wanted to make the distribution list of this newsletter aware that in addition to our historical leveraging of a dozen or so outside agencies, who remain a critical part of our vendor network, that we will now have those capabilities internally. I also thought it was important to use this new business venture as an example of how we should all keep an eye on the ever-changing market, identifying opportunities and running towards them; hopefully, all of you have opportunities to pursue and your running shoes on.

Matt Myers

President

Loan Performance

New Year same story, concerns about deteriorating consumer loan asset performance persist but collateral performance remains generally solid.

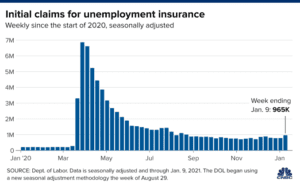

On the cause for concern side of the ledger is that we are still down 10mm jobs since February 2020 and jobless claims just spiked, which will likely exacerbate the dynamic where households are tapping into emergency savings.

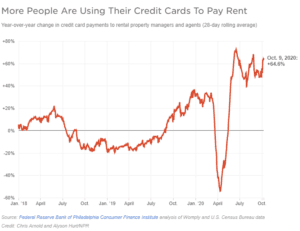

On the housing front, renters are more frequently using their credit cards to pay rent, forbearances continued to get extended at a high clip and there are foreboding signs about future evictions with recent data showing 35% of adults are past due on their rent of mortgage.

On the housing front, renters are more frequently using their credit cards to pay rent, forbearances continued to get extended at a high clip and there are foreboding signs about future evictions with recent data showing 35% of adults are past due on their rent of mortgage.

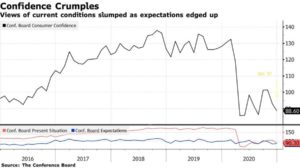

And Consumer confidence plunged in December, which is never a positive economic indicator (unless you are a distressed credit fund).

And Consumer confidence plunged in December, which is never a positive economic indicator (unless you are a distressed credit fund).

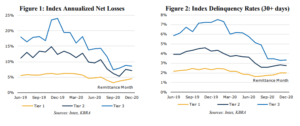

But despite signs of pending gloom and doom, and some mixed results on the card side, asset performance remains mostly immune. Most recently updated indices from Kroll with December payment date data (so November EOM) showed stable delinquency and charge-off rates in the personal loan space. And household bankruptcies for 2020 will be the lowest level since 1987.

But despite signs of pending gloom and doom, and some mixed results on the card side, asset performance remains mostly immune. Most recently updated indices from Kroll with December payment date data (so November EOM) showed stable delinquency and charge-off rates in the personal loan space. And household bankruptcies for 2020 will be the lowest level since 1987.

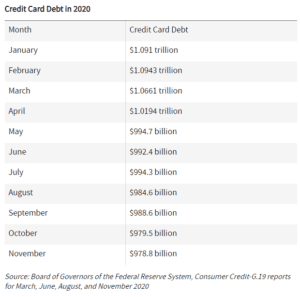

From a macroeconomic perspective credit card debt continues to decline while new credit card applications have plunged.

From a macroeconomic perspective credit card debt continues to decline while new credit card applications have plunged.

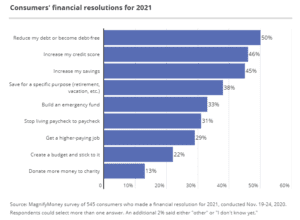

And consumers seem to be entering 2021 with their sights set on reducing debt and increasing savings which seems like an orientation that would support better consumer loan performance.

And consumers seem to be entering 2021 with their sights set on reducing debt and increasing savings which seems like an orientation that would support better consumer loan performance.

So back to where I started, while the calendar says 2021, the loan performance dynamics are solid data, despite concerns about the sustainability of it all, and feels very 2020.

So back to where I started, while the calendar says 2021, the loan performance dynamics are solid data, despite concerns about the sustainability of it all, and feels very 2020.

Regulatory

I have a feeling that the Regulatory section of the newsletter is going to get very exciting between the inauguration and years from now when the next congressional elections kick off. But for now…

It’s a little older news at this point but still important to note that for those hoping and praying the LIBOR transition can would get kicked, mission accomplished.

While this has not been passed, and might not be, given the changing of the guard in the White House and Senate it is good to familiarize oneself with the proposed changes via the Consumer Bankruptcy Reform Act of 2020.

The CFPB, which will probably look very different sooner than later, has been a bunch of busy bees. They took action against LendUp for violating MLA, hammered Discover (again), simplified the QM definition, launched an interactive enforcement database and published part 2 of the debt collection rule, effectively finalizing what is scheduled to go live at the end of November (unless the new administration alters that).

But it wasn’t all taking action against lenders and making rules at the CFPB. In the category of promoting innovation in lending the CFPB also issued another no-action letter around their use of AI in underwriting and also let Synchrony into the compliance sandbox as they look at rolling out a secured card that converts to unsecured to help with credit rebuilding.

But it wasn’t all taking action against lenders and making rules at the CFPB. In the category of promoting innovation in lending the CFPB also issued another no-action letter around their use of AI in underwriting and also let Synchrony into the compliance sandbox as they look at rolling out a secured card that converts to unsecured to help with credit rebuilding.

SCOTUS heard oral arguments around the definition of an audiodialer a case that we are watching very closely in our servicing and collections businesses. For those that have been following the circuit courts, there has been a lot of uncertainty around the definition of a dialer given the contradictory rulings in different federal districts.

In the category of least surprising things to happen, it took less than 60 days from the OCC issuing their True Lender rule for states to band together to sue and try to overturn it. Also not surprising, New York is leading the charge.

Random Stuff

Biden has recently signaled that credit bureaus ought to be replaced by the CFPB. Not even sure where to start with that one.

In the student loan world, where things will most assuredly look different under the Biden regime, payment deferrals on federal loans are going to get extended and I would personally be a little surprised if student loans remained non-dischargeable by 2022 based on the current rhetoric and trajectory of the dialogue. Last student loan note is that gigantic Wells book is going to Apollo and Blackstone.

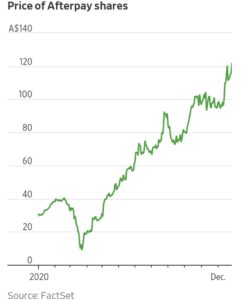

Buy-now-pay-later products have been all the rage lately, so much so that CapitalOne is not allowing their credit cards to be used in conjunction with them. It has proven a boon for the providers, Affirm just benefitted big time congrats if you were in on that IPO.

Speaking of going public, not shockingly SoFi went the SPAC route.

Speaking of going public, not shockingly SoFi went the SPAC route.