OPENING THOUGHTS

Change and uncertainty.

Those were the primary drivers behind my decision to start publishing a newsletter a little less than a year ago. I know I know, shocking that it was not my limited literary acumen that was the impetus. I always thought writing one about the consumer lending space would be something that hopefully added value for Goal Solutions partners and friends. With the onset of COVID, and the related spike in postponements and subsequent questions about what was coming next, that moved it out of the large category of things in my head I will likely never do, to something that actually came to fruition. I was having conversations every day with originators, investors, and warehouse providers who were worried about loss rates spiking and impairing portfolios, and distressed credit funds who were praying for that exact event to happen. Consolidating data we were/are seeing both publicly and in our own portfolios then wrapping it in my faux wit seemed like a good opportunity to connect with lots of people at once and try to keep them up to speed on the consumer loan asset class we focus on.

Fast forward to today. Somewhat ironically fears and concerns about loan performance that the newsletter was initially predicated on, have not come to fruition (yet), largely thanks to government support, to the happiness of the originators, investors, and lenders (plus rating agencies), and to the despair of the distressed credit funds. But change today is very real. The change we are seeing now is a different type of change, but the impact will be significant. The change I am referring to is the macro-political climate around consumer lending with the changing administration at the Federal level and a building tide among individual states to be more activist. We will likely see the CFPB revert to a more aggressive, shoot first ask questions later posture, doing discovery on issues through CIDs. We will continue to see more states taking a heavier hand in overseeing lenders, servicers, and collectors. In student loans, an asset class that we started out in and remain heavily involved into this day, we will see legislative and executive actions aimed at solving what is often referred to as a ‘debt crisis’ while likely not addressing the real issue which is a cost crisis in higher education. And overall we will see social policy get pursued through financial regulation as rules play whack-a-mole with the symptoms of socioeconomic dynamics, to which I say good luck with that.

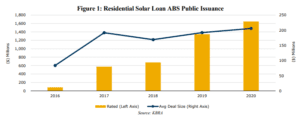

But not all is bad! Another asset class we spend lots of time in, residential solar will be a beneficiary of the change as renewables get a tailwind out of Washington. Similar benefits will likely be seen in C-PACE and we recently signed our first commercial hydroelectric generator lender client, in the category of asset classes that were not in the business plan. So while loan performance as measured by delinquency and charge-offs remains on the more mundane side of the news spectrum there is no shortage of things to talk about; it seems like there are good reasons for the newsletter to march on.

Stay safe.

Matt Myers

President

Loan Performance

Not a ton has changed in terms of the overall macro loan performance story, but still worth summarizing the current state of strong performance and lingering concerns using the most updated data especially as year-end data comes out.

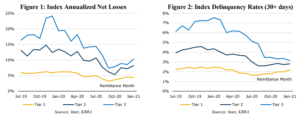

Starting off the loan performance section where the last issue left off, updated Kroll MPL data shows that while there has been some deterioration overall performance remains materially stronger than pre-COVID.

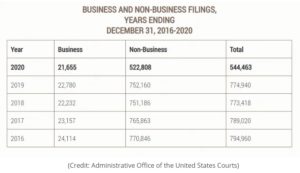

Probably not surprising given all the government support and low delinquency rates that came out of it, but still noteworthy that 2020 consumer BK filings declined significantly (~30%) from the 750k/year range that existed in the prior half-decade and were at the lowest filing level in 34 years.

Probably not surprising given all the government support and low delinquency rates that came out of it, but still noteworthy that 2020 consumer BK filings declined significantly (~30%) from the 750k/year range that existed in the prior half-decade and were at the lowest filing level in 34 years.

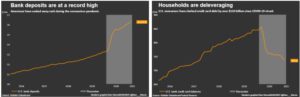

Driving the strong loan performance fundamentally 2020 was a year of saving and deleveraging for consumers, the upshot of which was significantly lower card balances and higher bank deposits.

Driving the strong loan performance fundamentally 2020 was a year of saving and deleveraging for consumers, the upshot of which was significantly lower card balances and higher bank deposits.

One other consequence of the deleveraging and saving that 2020 saw is that the average FICO score rose 7 points to 710, the highest increase ever. For reference purposes, the highest increase prior to 2020 was a 3.8-point rise in 2016.

One other consequence of the deleveraging and saving that 2020 saw is that the average FICO score rose 7 points to 710, the highest increase ever. For reference purposes, the highest increase prior to 2020 was a 3.8-point rise in 2016.

As a result of the solid loan performance and optimism of it continuing with the additional support being worked on in Washington, banks are starting to dial back loss reserves which is driving higher earnings.

As a result of the solid loan performance and optimism of it continuing with the additional support being worked on in Washington, banks are starting to dial back loss reserves which is driving higher earnings.

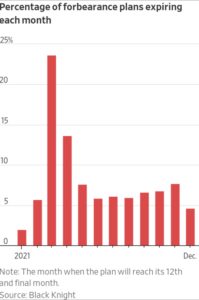

But this would not be a newsletter penned by me without calling out the signs of distress that exist, especially in the housing market. While forbearance rates are high and still rising there is a possible reckoning coming soon as roughly a quarter of the postponements came to an end in March.

But this would not be a newsletter penned by me without calling out the signs of distress that exist, especially in the housing market. While forbearance rates are high and still rising there is a possible reckoning coming soon as roughly a quarter of the postponements came to an end in March.

And while there were 3.4mm delinquent mortgages as of the end of 2020 and 10mm renters (18%) are behind on their payments consumers appear to be hoping that the new administration continues to extend the eviction moratorium. I’ve never thought much of hope as a strategy but seems to be working for people (and the equities markets) so far since COVID started, which shows how much I know.

And while there were 3.4mm delinquent mortgages as of the end of 2020 and 10mm renters (18%) are behind on their payments consumers appear to be hoping that the new administration continues to extend the eviction moratorium. I’ve never thought much of hope as a strategy but seems to be working for people (and the equities markets) so far since COVID started, which shows how much I know.

Regulatory

With the Biden administration getting into gear I think I could write 100 pages about the regulatory landscape. But nobody wants to read that much of my ramblings so I’ll do my best to be succinct about all that is going on.

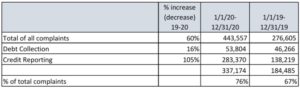

The CFPB is en fuego as they prepare for the arrival of a familiar face in Rohit Chopra to lead the new regime. While they wait for Rohit the interim director David Uejio has wasted no time in getting the agenda rolling announcing priorities which include some oldies but goodies from the Obama era like credit bureau reporting, debt collections, auto, prepaid cards, and student loan servicing. They also commenced a probe into Venmo, provided guidance for dealing with limited English proficiency borrowers, and threatened to halt implementation of initiatives from the prior regime (who said a final rule was actually ‘final’) such as revising the QM definition and more impactfully (at least to me) the revamped debt collections rules set to go in later this year. Lastly (at least for now) on the CFPB is the release of the 2020 complaint data. I guess it is not a shocker that the (what I thought was a crazy idea) notion I cited in the last newsletter about the CFPF becoming the lone credit bureau is gathering some steam, or at a minimum getting more attention.

Fresh off a name change and broadened mandate the artist is formerly known as the California Department of Business Oversight (DBO) now named the Department of Financial Protection and Innovation (DFPI) is opening new divisions, hiring people, and looking to justify its expanded budgetary existence by going after an always popular industry for regulators looking to generate headlines, debt collections.

Fresh off a name change and broadened mandate the artist is formerly known as the California Department of Business Oversight (DBO) now named the Department of Financial Protection and Innovation (DFPI) is opening new divisions, hiring people, and looking to justify its expanded budgetary existence by going after an always popular industry for regulators looking to generate headlines, debt collections.

Quick note on the circuit court world, TCPA interpretations continues to be as much art as law.

Random Stuff

Another month means another negative Navi headline, this one has them sending $22mm back to the DOE.

Sticking with student loans looks like loan cancellation is picking up steam. I would be surprised if the $50k number Warren has been pushing happened, but less surprised than a month ago.

I thought this article showing the companies with the largest consumer loan portfolios was pretty interesting.

The buy now, pay later march continues on.

More from Kroll, while 2020 was down in terms of ABS issuance in aggregate it did see growth in residential solar, where we spend lots of time. With the new administration, this should provide even more of a tailwind to the sector.

Despite the (at least what I perceive) success of Marcus looks like they are cutting costs and walking back from their initial goal of being profitable in 2021. As long as I can keep earning 50 bps on my Marcus online savings account…

Despite the (at least what I perceive) success of Marcus looks like they are cutting costs and walking back from their initial goal of being profitable in 2021. As long as I can keep earning 50 bps on my Marcus online savings account…