OPENING THOUGHTS

Hope everybody had a great Thanksgiving and long weekend! Crazy to think it is the start of the holiday season and 2021 is right around the corner; feels simultaneous like 2020 went by fast but has been a decade long, not sure how to reconcile that.

Our San Diego office recently announced that we won’t require people to be in the office until at the earliest 4/1/2021. That is symbolically important to me because we were last required to be in the office 3/16/2020 so it will be at least a year for most people between their last and next visit to the 20th floor of 402 West Broadway. Having pushed the opening date back now I believe something like 4 or 5 times I’m assuming that the 4/1 date is written in pencil, although the vaccine developments recently give me some hope (now we just have to make sure people actually go get them when they become available).

It has been something else running a business in COVID. Everything in areas like business development (COVID doesn’t mesh well with the conference business model) to hiring (remember when onboarding was boring?) have gotten turned on their head and there has been a healthy amount of trial and error to see what works best in a world that more closely resembles the Walking Dead than our former lives (ok maybe slight exaggeration). We recently (and long overdue) implemented weekly pulse surveys to ensure that the finger is on the pulse of the employee base, we know our employees are in a wide range of headspaces and need to monitor them all as close as we can to make sure we are doing out best to enable them to succeed and feel appreciated because they are our primary asset.

But there have been silver linings to COVID. The Goal Solutions business has grown and will have its best year ever in 2020 across revenues, EBIDTA and we crossed over $27b in total AUM. Our Launch Servicing business has grown 50% in the last 12 months. We recently created an internal recovery division that will bring third-party collections to market in January, completing a vertical integration we began a decade ago. People are leveraging VTC at a rate I never thought possible and that has increased connectivity especially with remote workers who were used to only communicating with most people via phone. VTC in a pandemic world is the gift that keeps on giving, every meeting is one disgruntled cat, excited dog or nap-deprived child away from inadvertent comedy for some and embarrassment for others.

Personally, I have had the opportunity to be around my daughter for nearly all her 11 months on this earth. Having so much time around her is a unique opportunity for me and most definitely the opposite of how it would have been in normal times (or what used to pass for normal), even if I am on the aforementioned VTC 80% of that time; she has definitely been the nap-deprived (or just curious) child interjecting her opinion unsolicited into a call or 20, people don’t even flinch anymore. Having the pleasure of listening to me be on calls all day every day (we live in a loft with basically no doors) my wife has assembled a list of all the things I apparently say regularly, she can’t wait to reveal that list to the people on my team when we can all finally see each other again.

I share all of that because while it sure has been a challenging and unique last 8+ months we always have to appreciate the good when stuck with the bad in life. As we go into the holiday season I sincerely hope that everybody maintains a positive mindset and safely enjoys their time with family and friends. I normally take off the last 2 weeks of the year so chances are this will be the last newsletter of 2020, let me be one of the first to wish everybody a great holiday season and a Happy New Year!

Matt Myers

President

Loan Performance

Still getting some contradictory signals around loan performance but feels a little like the tide is turning, and not in a good way (unless you are a distressed credit investor).

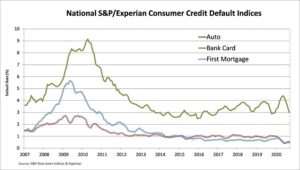

On the one hand some metrics show delinquency rates at near historical lows and charge-off rates remain depressed feeding off the postponement-driven low delinquency rates from the summer months, keeping the downward pressure on the S&P/Experian default indices that we keep an eye on that was shown in the newsletter last month. That all seems like it should drive some positive sentiment about consumer loan resilience.

Lending has been more constrained with banks keeping their underwriting standards tighter in Q3 and consumers keeping their debt loans at more constrained levels, hard to spend money when you can’t leave the house. A dynamic that has not boded well for LendingTree and others whose business models depend on consumer borrowing.

Lending has been more constrained with banks keeping their underwriting standards tighter in Q3 and consumers keeping their debt loans at more constrained levels, hard to spend money when you can’t leave the house. A dynamic that has not boded well for LendingTree and others whose business models depend on consumer borrowing.

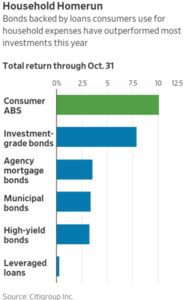

Fewer charge-offs and restrained borrowing feel like they should make loan holders feel positive about the portfolios that they hold. Results in the consumer ABS market have reflected the positive performance with tightening spreads and appreciating bond values.

Fewer charge-offs and restrained borrowing feel like they should make loan holders feel positive about the portfolios that they hold. Results in the consumer ABS market have reflected the positive performance with tightening spreads and appreciating bond values.

Despite the strong headlines there continues to be a sense of concern about what the future brings, and it seems not without reason especially as COVID builds a head of steam going into the holidays. Articles consistently show up questioning the ability of the strong consumer loan performance to continue as we approach the removal of support such as the end of the suspension of all student loan payments, Treasury announcing the end of certain support programs, loans continuing to exhaust postponement availability, etc., which is driving rating agencies like Moody’s to continue to beat a drum of pessimism as well as The Fed.

Despite the strong headlines there continues to be a sense of concern about what the future brings, and it seems not without reason especially as COVID builds a head of steam going into the holidays. Articles consistently show up questioning the ability of the strong consumer loan performance to continue as we approach the removal of support such as the end of the suspension of all student loan payments, Treasury announcing the end of certain support programs, loans continuing to exhaust postponement availability, etc., which is driving rating agencies like Moody’s to continue to beat a drum of pessimism as well as The Fed.

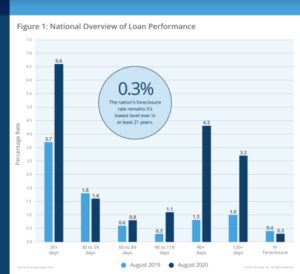

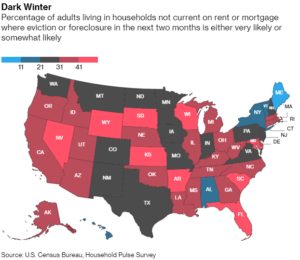

The concern around the state of the American consumer is not just theoretical in nature, the mortgage market continues to see elevated delinquencies (which includes postponements). People are still in their homes aided by the initial CARES Act granting of a 12-month postponement back in March and state-level eviction moratoriums. But with the initial postponements set to expire in Q1, moratoriums expiring in certain states while forbearance rates are back on the rise again after declining the prior 5 months and millions of people indicating an inability to be able to make their rent/mortgage payment, it does seem a bit foreboding.

And in the housing market when you do not pay that has very dire consequences. Pressure on mortgage and rent payments as postponements expire could cause consumers to reprioritize their wallets away from other obligations, specifically loan payments for things like student loans, personal loans and credit cards, where not paying just means that you have more money to pay your auto and housing expenses.

And in the housing market when you do not pay that has very dire consequences. Pressure on mortgage and rent payments as postponements expire could cause consumers to reprioritize their wallets away from other obligations, specifically loan payments for things like student loans, personal loans and credit cards, where not paying just means that you have more money to pay your auto and housing expenses.

Regulatory

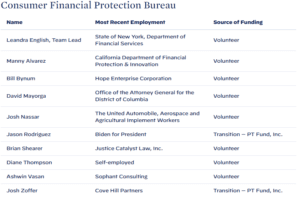

It was a more uneventful month on the regulatory front but feels like a calm before the storm with the extensive change forecasted under the Biden Administration. I bet Kathy Kraninger invested in some moving boxes when she saw Leandra English show up on the Biden CFPB transition team .

While material change at the Bureau might be afoot, it’s still doing stuff such as continuing to work on the rule-making around consumers accessing their financial data. The CFPB also recently announced they are holding off on a planned reorganization that would have impacted the enforcement division. Last CFPB-related topic, the company whose challenge to the Bureau’s structure ultimately resulted in the director becoming an at-will employee of the President looks like their judgment day on the original allegations is coming; Selia must feel like they won the battle but ultimately lost the war, whereas for everybody else they won the war.

While material change at the Bureau might be afoot, it’s still doing stuff such as continuing to work on the rule-making around consumers accessing their financial data. The CFPB also recently announced they are holding off on a planned reorganization that would have impacted the enforcement division. Last CFPB-related topic, the company whose challenge to the Bureau’s structure ultimately resulted in the director becoming an at-will employee of the President looks like their judgment day on the original allegations is coming; Selia must feel like they won the battle but ultimately lost the war, whereas for everybody else they won the war.

Plaid acquisition could be stopped in its tracks by the DOJ over monopolistic concerns. As a Plaid customer, I’m happy to see it, can’t imagine the acquisition would put downward pressure on their prices.

As we rapidly approach the 1/1 implementation date for the California Consumer Financial Protection Law here is a good Cliff’s Notes version. Given the broadness of the mandate and rules, I have a hunch this law is going to be felt near and far and wouldn’t be surprised to see other states follow suit.

In the circuit court world, a sort of crazy ruling that invalidates the TCPA retroactively back to 2015, which is when the government exception was created that was the basis for the designation of the law as unconstitutional this July. Assuming this stands it is a big win for debt buyers and collectors and a big loss for class action attorneys.

Random Stuff

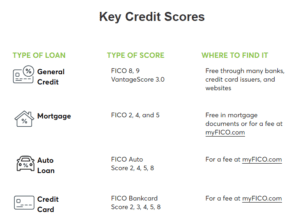

For those who are curious about what goes into credit scores and why there are so many version out there this guide could be helpful. Editorial Note: this should be useful to everybody.

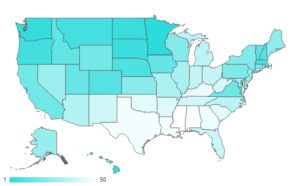

Speaking of FICO scores, here is a summary of average FICO scores by state . Some interesting data points and regional trends (South not looking so hot), including a 63-point spread between the highest (Minnesota! 720) and lowest (657, Mississippi) average scoring states.

Speaking of FICO scores, here is a summary of average FICO scores by state . Some interesting data points and regional trends (South not looking so hot), including a 63-point spread between the highest (Minnesota! 720) and lowest (657, Mississippi) average scoring states.

As mentioned earlier in the newsletter the current suspension of student loan payments for the Direct Loan Program expires at the end of the year. Definitely, something to keep an eye on it will have meaningful implications for borrower wallets and debt collectors.

Upstart filed its IPO papers recently. Here’s a fun drinking game: Drink every time ‘AI’, Artificial Intelligence’, or ‘Machine Learning’ shows up in their S-1; you’ll want to use a low alcohol content drink or you will get alcohol poisoning, by page 10.

Mike Cagney, who once vowed SoFi would ‘kill’ the banks, is (again) trying to become a bank. Deposit funding is a hard trick to compete with.