OPENING THOUGHTS

As we head into the election it feels a little bit like we are at the edge of an electoral precipice, and additional instability is exactly what the US needs right now with that whole COVID thing going so well. Even with all the current instability and congress’s unable to get their act together to provide additional stimulus, which I think we can probably mostly agree is needed with the size of support up for debate, things on the consumer loan front have largely remained on the tracks. Delinquencies and charge-offs have remained at low levels even as borrowers have migrated out of COVID postponements and payment activity has remained generally stable, we have even seen surges in prepayment activity in numerous portfolios as consumers invest in paying down debt.

With collateral performance holding up well and a lack of attractive investment alternatives ABS spreads have tightened significantly bringing cost of capital relief to lenders who rely on those markets for funding, driving a recent flurry of new issuance across asset classes (partly to get in front of the election volatility risk). And secondary market trading of whole loans seems to have defrosted following a lull we observed during Q2 and Q3 which is a big driven for numerous fintech originators. Consumer demand for certain products such as home improvement loans and funding for students attending short upskilling programs like computer coding boor camps has seen a surge as people remain at home, and with tightened underwriting policies the loans getting issued generally are higher quality. So all in all despite COVID seemingly being never-ending and the vaccine that is always right around the corner never-coming consumer loans feel like they are in a bubble, just not sure how thick the outer membrane is.

I wish I could say the same positive things about the Vikings, who are terrible. At least they put me out of my misery earlier in the season this year so I can dedicate more mind space and focus on my fantasy teams and not worry about fantasy incentives becoming misaligned with real world ones. At least that is what I tell myself. And the Vikings being so brutal leaves me more time to spend on other worthwhile endeavors like playing tennis, mountain biking and assembling this newsletter! I really hope you enjoy the latest edition, thanks for taking a few minutes to read it I know people’s time is scarce and valuable. Never hesitate to reach out with a question or to chat, I’m definitely not going anywhere anytime soon…

Matt Myers

President

Loan Performance

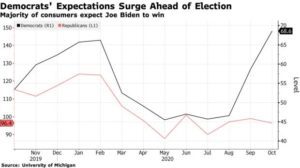

Overall the US consumer seems to be in a pretty solid spot. Confidence has recovered to some extent, especially among democrats anticipating a Biden win this week (or whenever the election finally settles). Consumer borrowing has fallen and spending habits have changed during the pandemic with a greater focus on paying down debt and increasing savings amidst the uncertainty.

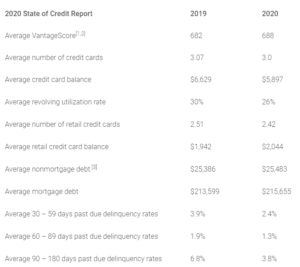

And results seem to be positive, at least as we sit here today. Defaults are down across a variety of asset classes and entities from banks to credit unions continue to hold their breath, but still are seeing strong performance from their consumer loan portfolios as government support (and not being able to leave ones house to spend money) creates a tailwind. Somewhat shockingly as the economy remains largely closed and unemployment high the average credit score recently hit a historically high level.

And results seem to be positive, at least as we sit here today. Defaults are down across a variety of asset classes and entities from banks to credit unions continue to hold their breath, but still are seeing strong performance from their consumer loan portfolios as government support (and not being able to leave ones house to spend money) creates a tailwind. Somewhat shockingly as the economy remains largely closed and unemployment high the average credit score recently hit a historically high level.

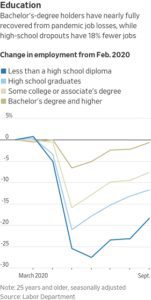

But there are still some material lingering risks. While politicians go back and forth about a K-shaped recovery it is clear that COVID has disproportionately impacted certain segments of the population, making them more vulnerable if the government support ceases.

But there are still some material lingering risks. While politicians go back and forth about a K-shaped recovery it is clear that COVID has disproportionately impacted certain segments of the population, making them more vulnerable if the government support ceases.

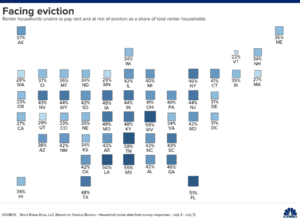

This goes especially for portfolios that have heavier near and subprime concentrations. Layer onto that the mixed messages around the health of the macro economy, ongoing lack of consumer savings to withstand prolonged disruptions to income, recent data points around missed housing payments and subsequent warnings from credit bureaus and it suggests that we are far from in the clear.

Regulatory

Fresh off the presses the OCC finalizes the true lender rule! Cue the state-level challenges.

A final rule even hotter off the presses is the long-anticipated (and delayed) debt collection rule from the CFPB, basically an updating of parts of the FDCPA. Depending on your viewpoint it either modernizes a set of laws that basically haven’t been touched since 1977 bringing them into the modern era and it is long overdue, or opens the door to increased harassment of consumers; they two are not mutually exclusive.

Speaking of the CFPB, they have also been busy settling with Encore, again, providing guidance on how to get out from under consent orders earlier and signaling their next area of focus, consumer access to their own financial data.

In the district court world, there were rulings that no TCPA lawsuits can be filed on calls made before July 6, 2020 (yes you read that right) and that a notice of a change of loan ownership is subject to the FDCPA.

At a more macro level, there are a handful of senate races that could (more like will) meaningfully impact the future of the consumer finance regulatory environment. Don’t forget to vote.

Random Stuff

Experian published an interesting (to me at least) summary of the state of consumer credit in 2020 with lots of YOY comparisons.

As people who follow me on LinkedIn know I have done my fair share of ranting about the cost of college over the years, so I was happy to see tuition increases being constrained (they will never stop increasing cost). While constrained tuition should (in theory) create less demand for private student loans, Well’s departure from the sector should create more dispersion among and opportunities for existing lenders.

As people who follow me on LinkedIn know I have done my fair share of ranting about the cost of college over the years, so I was happy to see tuition increases being constrained (they will never stop increasing cost). While constrained tuition should (in theory) create less demand for private student loans, Well’s departure from the sector should create more dispersion among and opportunities for existing lenders.

In the category of the rich getting richer Goldman continues to expand their card footprint with a big acquisition.

Lastly an interesting read from HBS examining the higher default rates that fintech originators experience relative to banks.